Last updated on 25 October 2024. All figures are as at this date. The changes from the last version are highlighted.

We, Argyle Street Management, have written this list of Q&A, to summarize what is happening with China Merchants China Direct Investments (CMCDI, 133 HK).

If you are new to CMCDI, this is a good place to start. This is a 10-minute read. We will update this post regularly.

最后更新于 2024 年 10 月 25 日。所有数据均截至该日期。与上稿差异部分以高亮标注。

我们Argyle Street Management为总结招商局中国基金(“招商局基金”,133.HK)最近的进展,写了一系列的問答。

如果你刚接触招商局基金,可以从这里开始。阅读本文需 10 分钟。 我们会定时更新本贴。

中文版紧接在英文版下面。

What is CMCDI?

China Merchants China Direct Investments (CMCDI, 133 HK, market cap ~US$ 290m) is a Hong Kong-listed “closed-end fund”.

Its largest shareholder is China Merchants Group (owns 28%), one of the largest state-owned enterprises in China.

CMCDI owns a diversified portfolio of high-quality assets, yet it is very undervalued. It is trading at price-to-net-asset-value (P/NAV) ratio of 0.45x only.

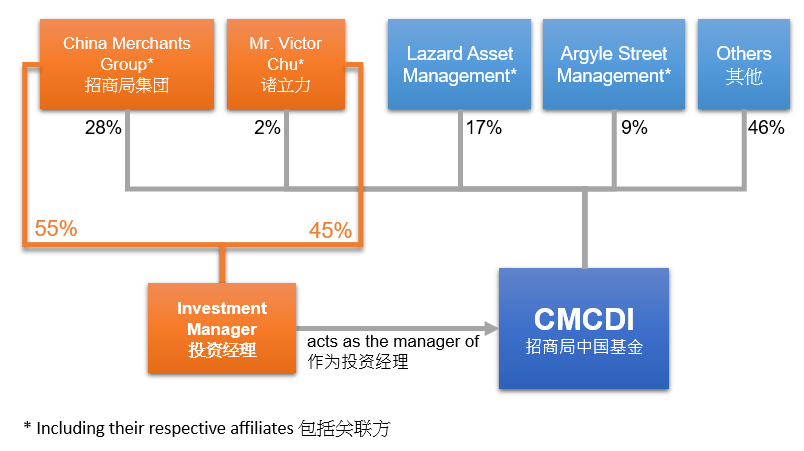

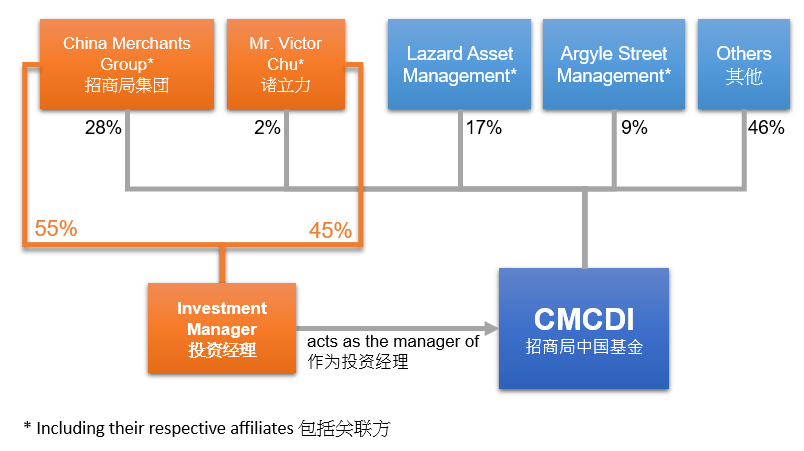

CMCDI has an external investment manager, which is owned by the affiliates of China Merchants Capital (55%) and Victor Chu (45%).

What is a “closed-end” fund anyways?

“Closed-end” means that investors (i.e. shareholders) are not allowed to redeem their investments. If investors want to cash out, they can only sell shares in the secondary market.

And that’s the problem: closed-end fund almost always trade at a (often large) discount to asset values.

What does CMCDI own in its portfolio?

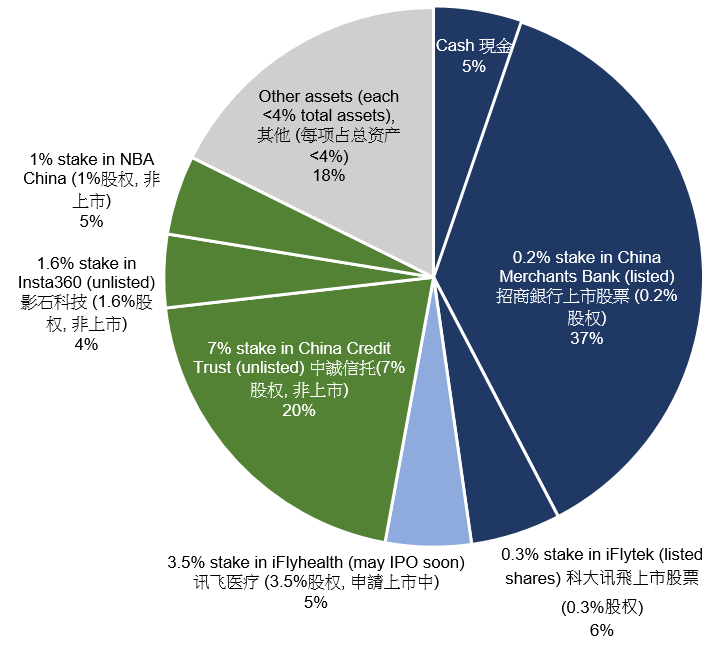

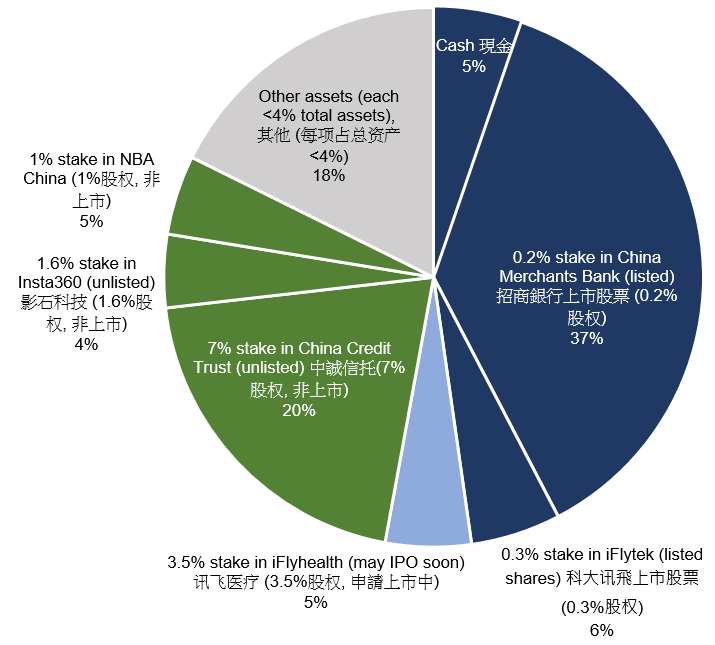

As at 30 September 2024, CMCDI’s total assets was US$ 798m, while its net assets were ~US$ 637m. Most of its liabilities were probably related to deferred taxes.

Here is a detailed breakdown.

Here is a quick snapshot:

Who are the shareholders of CMCDI?

Who is Argyle Street Management?

We, Argyle Street Management (ASM), are a Hong Kong-based fund manager. We focus on undervalued, high-quality assets in Asia with a viable path of unlocking value.

Our activism has successfully created value for many listed companies. For example:

| Listed company | Ticker | Outcome |

|---|---|---|

| HSBC China Dragon Fund | 820 HK | Liquidation of closed-end fund |

| ENM Holdings | 128 HK | Removal of directors, shutting down of unprofitable operations |

| China Motor Bus | 26 HK | Sale of largest asset, large special dividend |

| Dan Form | 271 HK | Takeover by strategic investor |

| Toshiba | Japan, delisted | Takeover by strategic investor |

| Ishii Iron | 6362 JP | Management buyout |

| TTK | Japan, delisted | Merger with competitor |

| Asia Resource Minerals | UK, delisted | Takeover by strategic investor |

| Guangdong Development Fund | UK, delisted | Liquidation of closed-end fund, removal of management |

| TIH Limited | TIH SP | Liquidation of closed-end fund, removal of management |

| CEI | Singapore, privatized | Privatization |

| Catcher Technology | 2474 TW | Intervention by regulator |

| Mount Gibson | MGX AU | Special dividends, board reshuffle |

What is the problem with CMCDI?

The first issue is the large discount to net asset value. It is currently trading at P/NAV ratio of 0.45x only.

For comparison, other reputable China-focused closed-end funds (e.g. HSBC, Morgan Stanley, Templeton, JPMorgan, Fidelity, Baillie Gifford) trade at P/NAV of ~0.8-0.9x.

The second issue is too much fees. CMCDI pays its manager far higher fees than peer closed-end funds, and yet CMCDI trades at far large discount to NAV.

What does ASM want CMCDI to do?

To narrow the discount, we propose that:

- Buyback offer: CMCDI shall make an offer to buy back 20% of its outstanding shares at 10% discount to net asset value. CMCDI has done that in the past.

- Discount management program: CMCDI shall implement a multi-stage “discount management program”, to gradually narrow the discount to 30% and eventually 20%. (more on this later)

- Cutting fees by streamlining the manager: the investment manager shall reduce fees by 45%. Currently, Victor Chu owns 45% shares in CMCDI’s manager. We propose that the manager shall be replaced by one fully owned by China Merchants Group. The existing team (minus Victor Chu and Elizabeth Kan) shall migrate to the new manager.

- Accountability: Renewing investment management agreement once a year (not every three years)

- Alignment of interest: Linking the manager’s fees to share price performance

- Improving investor relations: regular roadshows, better and more frequent disclosure

For details, read our full proposal (PDF, 30 pages). We updated the proposal on 4 October 2024.

How does “discount management program” (DMP) work?

That means: when share price of a closed-end fund trade at a wider discount than a predetermined target level (usually ~10%), the closed-end fund will buy back shares, until the discount narrows to the target level.

Many other respectable closed-end funds have some varieties of DMP. Our updated proposal has a few such case studies.

Like how the Federal Reserve provides forward guidance on interest rates, DMPs are self-fulfilling: once a closed-end fund announces a credible DPM, the Invisible Hand of market forces will cause the discount to narrow.

Who are Victor Chu and Elizabeth Kan? What’s wrong with them?

Victor is a co-founder of CMCDI, while Elizabeth is his lieutenant. Both are “responsible officers” of the manager of CMCDI. Also, Elizabeth is a director of CMCDI.

The issue is conflict of interest. Victor is the founder and principal of another venture capital firm (First Eastern), while Elizabeth is a senior executive. First Eastern does exactly what CMCDI does.

Institutional Shareholder Services (ISS), the dominant proxy advisor, agrees with our view. Almost all minority shareholders (including ASM) voted against Elizabeth.

We have written a 16-page presentation on this subject.

How did CMCDI respond?

On 27 September 2024, CMCDI responded for the first time. It announced plans of buying back shares in 2025 and beyond. Disappointingly, the plans are vague: CMCDI did not talk about the size and the price of the buybacks, or which asset will be sold to fund the buybacks.

Around October 2024, CMCDI published an FAQ page on its website. It offered five feeble excuses of why it cannot implement a discount management program.

On 18 October 2024, CMCDI announced that it entered into a new investment management agreement with the incumbent manager. Other than cutting management fees slightly by 25 basis points, CMCDI offers nothing. No asset disposal, no buy backs, and no discount management program.

We (and many shareholders) find CMCDI’s responses unacceptable.

Two EGMs will take place near the end of 2024. What is that about?

The new investment management agreement requires the approval of independent shareholders (i.e. China Merchants Group and Victor Chu affiliates cannot vote) at an extraordinary general meeting (EGM). Exact date is to be confirmed.

On 9 October 2024, ASM’s entities requisitioned CMCDI to convene an EGM, to put two resolutions to vote:

- #1: the term of new investment management agreements with the incumbent manager shall be one year, not three years.

- #2: remove Elizabeth Kan from the board of CMCDI

On 24 October 2024, CMCDI announced that it will convene our EGM soon. The exact date is to be confirmed, too.

We encourage all shareholders to exercise your independent judgement when you vote. ASM has no present intention to act in concert with anyone.

If CMCDI’s external manager is removed, will CMCDI decay into a management-less anarchy?

We are not worried. We will write a blog post on this subject.

Essentially, CMCDI is a listed company that has its own directors and can hire employees to manage itself.

It is not a must to have an external manager, which, in fact, reports to the board and has little power.

What is the endgame?

ASM would like to work constructively with CMCDI, the investment manager and all shareholders.

Why are hedge funds are going after other closed-end funds?

Since 2023, there has been a global trend of closed-end fund activism, because of wide discount to NAV and poor corporate governance.

Saba Capital, the global leader in this space, managed to force BlackRock funds to implement a discount management program.

Elliot Management compelled the largest investment trust in the UK to do the largest-ever share buyback, and is trying the same with Softbank.

City of London Investment Group forced some BlackRock funds to buy back shares.

These activist will all be surprised that Hong Kong has a closed-end fund that trade at such massive discount: CMCDI.

What does the media say about CMCDI?

Here is all the media coverage that we know about:

How do I get news on CMCDI?

Subscribe to our website:

How do I contact ASM?

If you are a shareholder, we would love to hear your thoughts.

💬 WeChat 微信: ASM_Argyle

💬 WhatsApp: +852 6317 6371

🖥️ UnlockValueChinaMerchants.com

我们Argyle Street Management为总结招商局中国基金(“招商局基金”,133.HK)最近的进展,写了一系列的问答。

如果你刚接触招商局基金,可以从这里开始。阅读本文需 10 分钟。

我们会定时更新本贴。

招商局中国基金是谁?

招商局中国基金 (招商局基金, 133 HK, 市值约2.9亿美元) 是一个在香港联合交易所挂牌上市的“封闭式基金”。

其最大股东是招商局集团(持有28%的股份),招商局是中国最大的国有企业之一。

招商局基金拥有多样化的优质资产组合,但其估值非常低。其市净率仅为0.45倍。

招商局基金有一个外部投资经理,由招商局资本(55%)和诸立力先生(“诸先生”, 45%)的关联企业共同拥有。

“封闭式”基金是什么意思?

“封闭式”意味着投资者(即股东)不被允许赎回他们的投资。如果投资者想要变现,他们只能在二级市场上出售股份。

而这就是问题所在:因此封闭式基金几乎总是以(有时很大的)较低市净率折价交易。

招商局基金的投资组合中有什么?

截至2024年9月30日,招商局基金的总资产为7.98亿美元,而其净资产约为6.37亿美元。其大部分负债与递延税款有关。

此处是其资产分布的详细情况:链接。

此处是资产情况概览:

招商局基金的股东是谁?

Argyle Street Management是谁?

我们Argyle Street Management (ASM)是一家总部位于香港的基金管理公司。我们专注于亚洲地区低估、优质的资产,并具有可以实现增值的可行路径。

我们的积极股东行动已经成功为许多上市公司创造了价值。例如:

| 上市公司名称 | 股票代码 | 结果 |

|---|---|---|

| HSBC China Dragon Fund 匯豐中國翔龍基金 | 820 HK 香港 | 封闭式基金投资组合清算 |

| ENM Holdings 安寧控股 | 128 HK 香港 | 辞退了表现较差的董事,关停了亏损业务 |

| China Motor Bus 中華汽車 | 26 HK 香港 | 出售了主要资产、大额增派特别派 |

| Dan Form 丹枫控股 | 271 HK 香港 | 被战略投资人收购 |

| Toshiba 東芝 | 日本, 已退市 | 被战略投资人收购 |

| Ishii Iron 株式会社石井鐵工所 | 6362 JP 日本 | 管理层进行要约回购 |

| TTK | 日本, 已退市 | 与竞争者合并 |

| Asia Resource Minerals | 英国, 已退市 | 被战略投资人收购 |

| Guangdong Development Fund 广东发展基金 | 英国, 已退市 | 投资组合清算,更换管理层 |

| TIH Limited | TIH 新加坡 | 投资组合清算,更换管理层 |

| CEI | 新加坡, 私有化 | 成功私有化 |

| Catcher Technology 可成科技 | 2474 台湾 | 被监管机构就公司治理相关问题调查 |

| Mount Gibson | MGX AU 澳洲 | 派发特别股息,董事会重组 |

招商局基金存在哪些问题?

其第一个问题是与净资产价值之间的巨大折价。目前,它的市净率(P/NAV)比率仅为0.45x倍。

相比之下,其他知名的专注于中国的封闭式基金 (例如:汇丰HSBC, 摩根士丹利Morgan Stanley, 邓普顿Templeton, 摩根大通JPMorgan,富达 Fidelity, 柏基Baillie Gifford) 的市净率(P/NAV)比率约为0.8-0.9倍。

第二个问题是投资经理收取费用太多。招商局基金支付的管理费远远高于其他知名的封闭式基金,然而交易折价更大。

ASM希望招商局基金采取什么行动?

为了缩小折价,我们提议:

- 回购要约: 招商局基金应该提出回购要约方案,以较净资产折让10%的价格回购招商局基金已发行股份的20%。招商局基金以前回购过股份。

- 折价管理计划:招商局基金应该实施多阶段的“折价管理计划”,逐步缩小折价至30%,最终缩小至20%。

- 通过简化管理人员来降低费用:投资经理应该把收费下调45%。目前, 诸立力先生拥有投资经理45%的股份。我们建议将管理人员替换为招商局集团全资拥有的公司,现有团队(除诸立力先生和简家宜女士外)应该迁移到新的管理公司。

- 问责机制:投资管理协议按年度续签( 而不是每三年续签一次)

- 利益一致:将投资经理收取的费用与股价表现情况挂钩

- 改善投资者关系:定期路演,更好、更频繁的信息披露。

详细内容请参阅我们完整的报告(PDF, 30 页)。我们在10月4日对提案进行了更新。

“折价管理计划”是如何实现目标的?

这意味着当封闭式基金的股价折价幅度超过预定目标水平(通常约为10%)时,封闭式基金将回购股份,直到折价缩小至目标水平。

许多知名的封闭式基金都有明确的“折价管理计划”(Discount Management Program)。我们的更新提案列举了部分基金的情况。

就像美联储管理市场对利率预期一样,折价管理计划也是自我实现的。折价管理计划可以引导市场朝着特定的折价水平发展,自然而然缩小股价折让。

诸立力先生和简家宜女士是谁?他们有什么问题?

诸先生是招商局基金的联合创始人,而简女士是他的副手。他们两人都是投资经理的“负责人员”(”responsible officers“)。此外,简女士还是招商局基金的董事。

最大的问题是利益冲突。诸先生是另一家风险投资公司(第一东方)的创始人和负责人,而简女士是高级执行官。第一东方的业务正是招商局基金所从事的业务。

全球最大的”投票代理顾问”(proxy advisor)Institutional Shareholder Services与我们的观点一致。几乎所有少数股东(包括ASM在内)都投票反对简女士董事连任。

我们就此话题写了一个16页的详细展示文件。

招商局基金作出了何种回应?

2024年9月27日,招商局基金首次回应了我们。它宣布或于 2025 年及之后进行股票回购公开要约的计划。但是招商局基金模糊的回应令人失望。招商局基金并没有提及回购的规模和价格,也没有说明将出售哪些资产来支付回购所需资金。

大约在2024年10月,招商局基金在其网站上发布了一个常见问题解答页面。它提供了五个苍白的借口,表示为什么无法实施折扣管理计划。

2024年10月18日,招商局基金宣布已与现任投资经理签订了一份新的投资管理协议。除了管理费仅略有降低25个基点(即0.25%)外,招商局基金未提及任何其他措施减小折价。完全未提及如何进行资产处置、未提及股票回购计划,也没有折扣管理计划。

我们(以及许多股东)认为招商局基金的回应是不可接受的。

将于2024年底举行二次特别股东大会。这是关于什么的?

新的投资管理协议需要在特别股东大会上征得独立股东的批准(即招商局集团和诸立力先生(及其各自的关联方)作为“关联人”无法投票)。具体投票日期尚未确定。

2024年10月9日,我们管理的实体向招商局基金提交了要求召开特别股东大会的要求。

- 动议 1: 新投资管理协议之期限不得超过一(1)年

- 动议 2: 免除简家宜女士

2024年10月24日,招商局基金公告其将召开特别股东大会。具体日期待定。

各股东在投票时应独立判断。我们目前没有与任何人一致行动的计划

如果招商局基金的外部投资经理被撤职,招商局基金会陷入无管理的混乱状态吗?

我们并不担心。我们将就这个问题撰写一篇文章。

基本上,招商局基金是一家上市公司,拥有自己的董事会,并可以雇佣员工自己管理。

外部投资经理并非必须的。事实上,外部投资经理需要向董事会汇报并仅有有限的权利。

最终目标是什么?

ASM希望与招商局基金、投资经理和所有股东建立建设性的合作关系。

为什么对冲基金开始对其他封闭式基金采取行动?

自2023年以来,由于普遍的净资产价值折价和糟糕的公司治理,针对封闭式基金积极股东行动成为全球趋势。

Saba Capital 作为该领域的全球领导者,成功迫使黑石基金实施折价管理计划。

Elliot Management 迫使英国最大的投资信托进行有史以来最大规模的股份回购,并试图对软银采取同样的行动。

City of London Investment Group 迫使部分黑石(Blackstone)管理的基金回购股份。

这些积极股东行动者都会惊讶于香港有一只封闭式基金能够以如此大幅度的折价交易:招商局中国基金。

媒体对招商局基金有何报道?

以下是我们所了解到的所有媒体报道:

如何收到招商局基金的最新消息?

可用电邮订阅本网站:

如何联系ASM?

如果你是招商局基金的股东,欢迎随时跟我们沟通你的想法。

💬 微信: ASM_Argyle

💬 WhatsApp: +852 6317 6371

Leave a reply to 🙏 Thank you for coming / 感谢来访 – Unlocking Value Cancel reply