About us 关于我们

Argyle Street Management (ASM) is a Hong Kong-based fund manager. We focus on undervalued, high-quality assets in Asia with a viable path of unlocking vaue. This website is operated by ASM.

Argyle Street Management (ASM) 是一家总部设于香港的基金管理公司。我们专注投资亚洲被低估、而且有途径释放价值优质资产。本网站由ASM运营。

ChinaMerchants@asmhk.com

About China Merchants China Direct Investments Limited 关于招商局中国基金

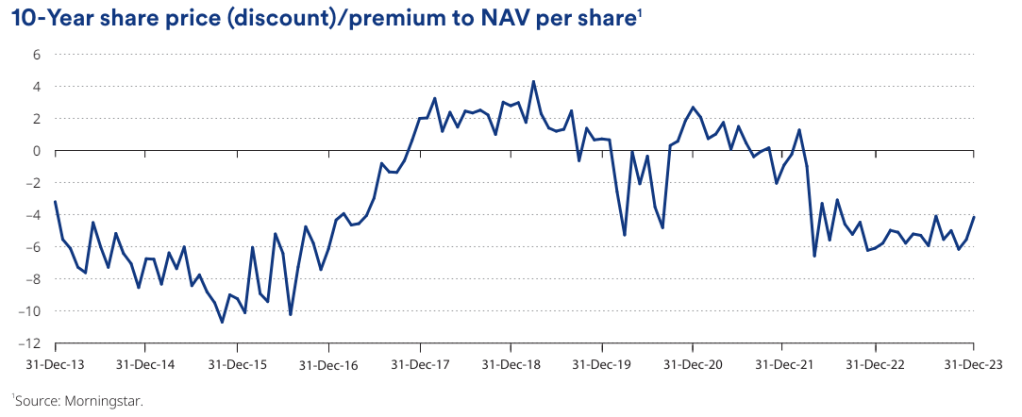

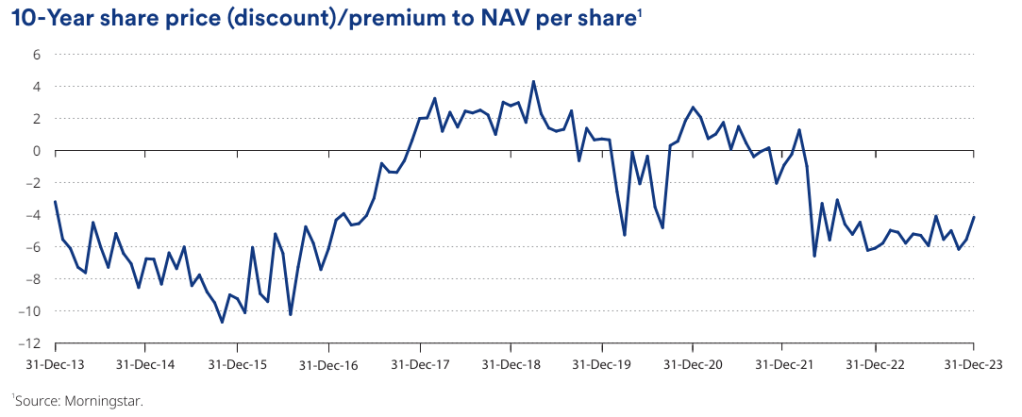

China Merchants China Direct Investments Limited is a Hong Kong-listed closed-end fund (the “Fund”, 133 HK) managed by a manager affiliated with the China Merchants Group. Its share price is at large discount to its net asset value. Entities managed by ASM are shareholders of the Fund. This website is not operated by the China Merchants Group or the Fund. This is not the official website of the Fund.

招商局中国基金有限公司是一只在香港上市的封闭式基金(「中国基金」,133 HK),由招商局集团下属的管理人管理,其股价较其资产净值大幅折让。ASM 的相关实体是中国基金的股东。本网站并非由招商局集团或中国基金运营,也不是中国基金的官方网站。

Disclaimer and Terms of Use 重要声明

本网站所有內容,中文版本为英文版本译本,如中、英文两个版本有任何抵触或不相符之处,应以英文版本为准。 For all content on this website, the Chinese version is a translation of the English version. If there is any conflict or inconsistency between the Chinese and English versions, the English version shall prevail.

Please read this notice in its entirety. This notice contains important legal information. This site is directed to and may only be accessed by persons who have the necessary standing in their relevant jurisdiction (being for example persons who are accredited, professional, sophisticated and/or qualified investors only, as defined in the relevant jurisdiction). Any view or use of this website constitutes your agreement to be bound by the then-current terms and conditions set out herein. If you do not agree to all the terms and conditions set out herein, you may not use our site. By using the site, you are deemed to have accepted these terms and conditions. The view or use of this site may be restricted by local law or regulation in certain jurisdictions. This information is not intended to be made available to any person with a view to causing a fluctuation in the market price nor inducing purchase and sales of securities in any jurisdiction where doing so would contravene any laws or regulations. By accessing this website you confirm that you are aware of the laws in your own jurisdiction relating to the provision and sale of securities, financial/investment services and products. You represent that you will not utilize the information contained in this site in a manner that could contravene such laws by ourselves or any other person. This website is not directed to any person in any jurisdiction where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this website is prohibited. Persons in respect of whom such prohibitions apply must not access this website. The information provided on the website is not intended for distribution to, or use by, any person or entity in any jurisdiction or country that would subject Argyle Street Management Limited (“ASML”), any fund under its management, or any affiliate thereof (together, “ASM”), to any registration requirement within such jurisdiction or country. ASM makes no warranties that materials on this website are appropriate or available for use in your jurisdiction. If it is illegal or prohibited in your country of origin to access or use this website, then you should not do so. Those who choose to access this website do so at their own initiative and are responsible for compliance with all local laws and regulations. The information published on this site is general in nature and for informational purposes only. The information published is not to be relied upon and ASML bears no responsibility to anyone who relies on the information published. The information published and shall not be construed as an offer or solicitation to subscribe in the funds or securities or other products which may be referred to in this site and does not constitute investment advice or solicitation for investment in any fund, or securities or other products. Nothing on this website shall be considered a solicitation to exercise, by proxy, any person’s voting rights in a way that violates applicable laws and regulations in any jurisdiction. ASM disclaims its intention to be treated as a joint holder with other shareholders by virtue of its act to express its view or opinion or other activities to engage in dialogue with other shareholders in or through this website. The information does not take into account your personal circumstances, financial needs or objectives. Before acting on any information, you should consider the appropriateness of it having regard to your objectives, financial situation and needs. In particular, you should seek independent advice from your advisers (such as legal, financial and tax advisers) prior to acting on any information provided on this site. The information on the website is provided for information only and should not form the basis of an investment decision. ASM does not provide investment advisory or management services to the public. Any information on this site is selective, may not be complete and has not been reviewed by any regulatory authority. The information that ASM provides is for your information only. Some information provided may not be current, or may have changed since the last time you viewed or downloaded it. All information is subject to change without notice. ASM makes no warranty or representation, express or implied, as to the accuracy, validity, completeness or fairness of any information contained in this site, or that it is accurate, reliable, up to date or complete. ASM accepts no responsibility or liability for any loss, damage, cost or expense incurred by you as a result of any error, omission or misrepresentation on any information on this site. While ASM makes reasonable efforts to provide accurate information, ASM has no obligation to update or correct any information contained on this website. ASM reserves the right to amend the information on this site at any time without notice. In no event shall ASM be liable for any claims, liabilities, losses, costs or damages including direct, indirect, punitive, incidental, special or consequential damages, arising out of or in any way connected with the use of or inability to use this website or with any delay in using this website. Your use of this website and use or reliance upon any of the information in it is solely at your own risk. ASM reserves the right to change the terms and conditions contained herein without notice at any time. Any reproduction of this website or the information contained herein, in whole or in part, is prohibited. Our prior permission is required for any commercial use of materials on this website. Any unauthorized use of the images on this website may violate copyright laws, trademark laws, the laws of privacy and publicity, and communications regulations and statutes. You acknowledge and agree that this site contains information, data, software, photographs, graphics, text, images, logos, icons, typefaces, audio and video material, and/or other material (collectively “Content”) protected by copyrights, trademarks, or other proprietary rights, and that these rights are valid and protected in all forms, media, and technologies existing now or hereinafter developed. Without limiting the foregoing, the Content includes any reports that may be accessed through the site. The Content is our property or that of our suppliers or licensors. The compilation (meaning the collection, arrangement, and assembly) of all content on this site is our exclusive property and is protected by Hong Kong and international copyright laws. You may not modify, remove, delete, augment, add to, publish, transmit, participate in the transfer, license, sell, create derivative works from, or in any way exploit any of the Content, in whole or in part. You may not upload, post, reproduce, perform, or distribute in any way any Content without obtaining permission of the owner of the copyright, trademark or other proprietary right. When you visit our site, we will record your visit only but will not collect any personal data from you unless otherwise stated. Cookies used (if any) in any part of our websites will not be deployed for collecting personal data. For your information, Cookies are small computer files that can be stored in web surfers’ computers for the purposes of obtaining configuration information and analyzing web surfers’ viewing habits. They can save you from registering again when re-visiting a website and are commonly used to track your preferences in relation to the subject matter of the website. You may refuse to accept Cookies by modifying the relevant Internet options or browsing preferences of your computer system, but to do so you may not be able to utilize or activate certain available functions in our websites. Our websites may bar users who do not accept Cookies. ASML is regulated by the Securities and Exchange Commission as an Investment Adviser in the United States of America. ASML is licensed for Type 4 (Advising on Securities) and Type 9 (Asset Management) activities by the SFC (and ASML must seek the Hong Kong Securities and Futures Commission (“SFC”)’s approval before extending services to the retail level). Funds on this site are not authorised by the SFC for sale to the general public in Hong Kong. This site has not been reviewed by the SFC.These terms and conditions of use might be changed from time to time and the latest version will be posted on here. If you do not agree with the changes in the terms and conditions of use, your sole remedy is to discontinue the use of the site. By using this site after we post any changes to this policy, you thereby agree to accept those changes. These terms and conditions of use shall be governed by and construed in accordance with the laws of Hong Kong, without reference to its conflicts of laws principles. Any dispute relating to the above shall be brought solely in the courts of Hong Kong and it is agreed that such courts shall have jurisdiction over the parties to these terms and conditions of use and any disputes arising hereunder.

Leave a comment